Identify a True Statement About Mergers and Acquisitions

Meeting with your senior management for strategic planning sessions. Mergers and acquisitions.

The Secret Life Of Change Managers What We Do And How We Do It Change Management Change Leadership Management

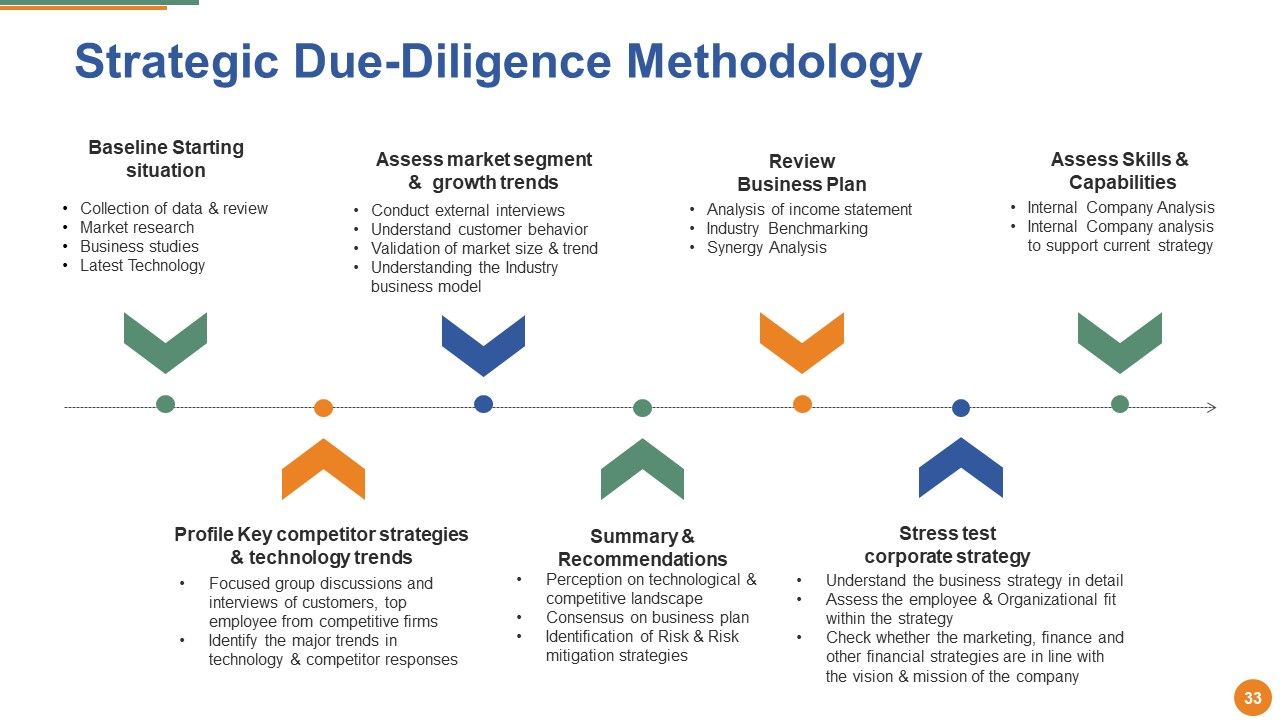

Pre-acquisition planning to Post-acquisition integration is our mission.

. Our thorough approach includes. Mergers and Acquisitions Buy Side Activity. MA is one of the major aspects of corporate finance world.

In the context of mergersacquisitions a major challenge in the post-merger environment involves _____. Tax considerations and strategies are likely to have an important impact on how a deal is structured by affecting the amount timing and composition of the price offered to a target firm. The reasoning behind MA generally given is that two separate.

Identity a true statement about mergers аnd acquisitions. An us versus them mentality among employees of a newly merged organization is crucial for the success of the merger. Tax factors are likely to affect how the combined firms are organized following.

Section 7 of the Clayton Act prohibits mergers and acquisitions when the effect may be substantially to lessen competition or to tend to create a monopoly The key question the agency asks is whether the proposed merger is likely to create or. Mergers and acquisition threaten the self-identity of the employees involved. It is likely to be used by firms that have small international sales limited geographic diversity or few executives with international expertise.

There are enough deals that have been concluded - good and bad - that can be learned from. Successful Mergers and Acquisitions. As Dell-EMC merged into one the global technology industry cheered.

The main difference between a merger and an acquisition is that a merger is a form of legal consolidation of two companies which are formed into a single entity while an acquisition happens when one company is absorbed by another company which means that the company that is purchasing the other company continues to exist. Mergers and Acquisitions MA Transactions Types 1. Mergers and acquisitions MA is a general term that describes the consolidation of companies or assets through various types of.

The failure or success of mergers and acquisitions can be assessed by looking at stock prices. Financial buys discuss the importance of synergies hard and soft synergies and identify. Theres no need to reinvent the wheel every time you decide to participate in mergers and acquisitions.

Mergers and acquisitions MA are defined as consolidation of companies. In this guide well outline the acquisition process from start to finish describe the various types of acquisitions strategic vs. The 8 Biggest Mergers and Acquisitions Failures of All Time Top 10 Reasons why Mergers Acquisitions Fail Conclusion.

Cincinnati Capital Corporations activities extend far beyond the typical buyer representative. MNCs identify the true statements about an international division structure. Which of the following is not true about mergers and acquisitions and taxes.

Differentiating the two terms Mergers is the combination of two companies to form one while Acquisitions is one company taken over by the other. The process of identifying and evaluating a tar get fi rm completing a deal. Mergers and acquisitions were responsible for many of the closures and federal agencies have not.

After years of steady courtship the deal finally saw the light of the day. Horizontal A horizontal merger happens between two companies that operate in similar industries that may or may not be direct competitors. In an organization the human resources manager should become the final arbiter of which.

Overview of the MA Process. One firm usually dominates in terms of market share size or value of assets D. Mergers and acquisitions succeed when the policies and procedures in the new firm are based solely on the policies and procedures of one the parties involved.

7 th September 2016 will be celebrated as a big day in the history of the global technology industry as the merger between Dell-EMC came to fruition. The mergers and acquisitions MA process has many steps and can often take anywhere from 6 months to several years to complete. After its negotiation and announcement and then integrating a target fi rm after.

Which of the following routes is a multinational company MNC likely to choose in order to quickly expand resources or construct high-profit products in a new market. Most mergers and acquisitions can take a long period of time from inception. BThe failure or success of mergers and acquisitions is assessed by looking at employee turnover.

Few true mergers actually happen -- one party is usually dominant in market share size Acquisition 2 One firm buys a controlling or 100 interest in another firm with the intent of making the acquired firm a subsidiary business within its portfolio The purchase of another company Takeover def 2 types. Integration problems are more severe than in outright acquisitions C. Meanwhile an acquisition refers to the takeover of one entity by another.

Mergers and Acquisitions Can Take a Long Time to Market Negotiate and Close. The EO stated that the United States has lost 70 percent of its banks in the past four decades with around 10000 bank closures. ASuccessful mergers and acquisitions result in lower research-and-development expenditure.

Employees involved in mergers and aquisition should retain their self-identity. Identify a correct statement about mergers and acquisitions. There are few true mergers because A.

If you never ask you will never know. True mergers result in significant managerial-level layoffs. Few firms have complementary resources B.

Although a lot of attention is paid to big mergers and acquisitions the public is less aware that many of these mergers and acquisitions actually fail. Identify a true statement about export arrangements in the context of initial division structure. Vertical A vertical merger takes place between a company and its supplier or a customer along its supply chain.

The employees of the acquiring firm are seen as allies by the employees of the acquired firm. A merger occurs when two separate entities combine forces to create a new joint organization. CThe failure or success of mergers and acquisitions can be assessed by looking at stock prices.

Merger And Acquisition Indonesia Procedures Required Documents

Mergers And Acquisitions Deloitte

Top Hr Challenges During Mergers And Acquisitions And How To Handle Them Merger Challenges Company Culture

Pin On Drawing Ideas Step By Step Videos Music

Best Guide On Corporate Finance Theory Practices Finance Accounting And Finance Finance Class

Mergers And Acquisitions Financial Advisory Deloitte Brazil

Hr Annual Report Template Professional Small Business Financial Statement Template Caquetapositivo Financial Planning Financial Analyst Business Plan Template

Merger And Acquisition Powerpoint Presentation Slides Presentation Graphics Presentation Powerpoint Example Slide Templates

Real Estate Investment Partnership Business Plan Template Valid Pertaining To Real E Financial Plan Template Business Plan Template Free Business Plan Template

Secrets To Winning M A Project Management Smartsheet

M A Mergers Acquisitions Strategy Consulting Bcg

Pin On Books Free Download Pdf

The Top 4 Executive Resume Examples Written By A Professional Recruiter Professional Resume Examples Executive Resume Template Executive Resume

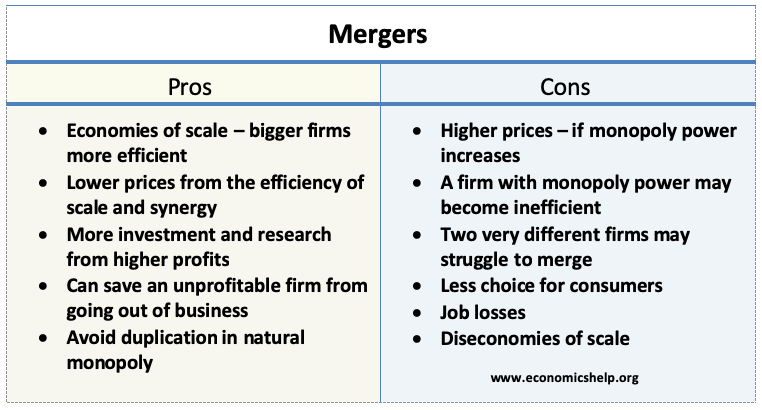

Pros And Cons Of Mergers Economics Help

Mergers And Acquisition Advisory San Francisco Business Valuation Exit Strategy Blog Strategy

Eight Minutes To Performance Improvement Seidman 2007 Performance Improvement Improve Performance Student

The Management Of Tax Risks In Mergers And Acquisitions The Importance Of Tax Due Diligence Intechopen

Comments

Post a Comment